How to Organize Forms & Finances

This post is Day 22 in the 31 Days to a Super-Purposeful Schedule series.

I've shared before how I am NOT a numbers person. I have the ability to do the math, analyze stats and try out different formulas. But do I like it? No. Do I avoid it at all costs? Yes!

Unfortunately to run a healthy business, it means we have to make sure everything is in order. And that includes the numbers. It also includes filing taxes, creating reports and understanding how to prioritize my schedule - all of which need a good system in place to work well.

If you don't have good administrative systems in place you'll find yourself dealing with the following...

Not knowing exactly where you stand financially and wondering where your money goes.

Working a ridiculous amount of hours and never having a spare second to relax.

Feeling like you can never find out what you need to know because it's all thrown together and disorganized.

Systems for administrative tasks can look like routine checklists, workflows, and planners. You might use a handbook or manual as a system to keep track of all the guidelines in your work. They could come in the form of a digital filing system, a reporting software or a budget-tracking app. Basically, any tool or process that helps you get your forms and numbers organized is an administrative system.

CREATE YOUR OWN ADMINISTRATIVE SYSTEMS

1 | WEEKLY MAINTENANCE CHECKLIST

Every day of the week for me needs its own focus and checklist. So after working through my customer systems, blog/website systems, selling systems, and marketing systems, next in line is a checklist for my admin systems. For Fridays, I go through tasks like recording income and expenses, creating a weekly productivity report, comparing stats to standards, reviewing calendar and goals, adding important info to manuals, etc. Usually, these tasks only take a few minutes each and it's amazing how much better I feel after completing them. I instantly have a pretty clear idea of how things are looking.

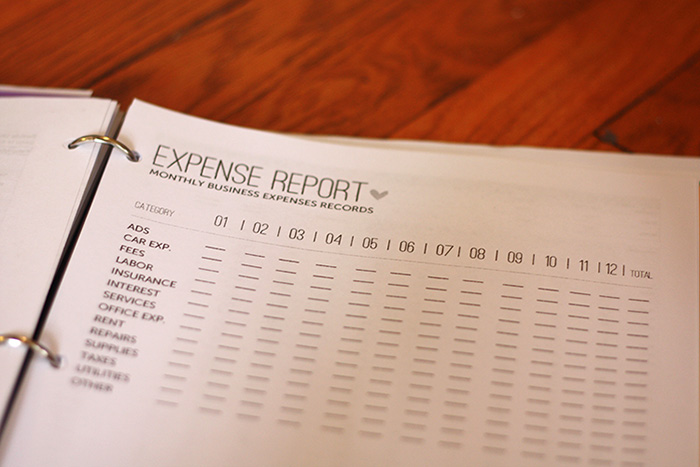

2 | PUT TOGETHER A FINANCE BINDER

Even if you have someone who logs all the numbers for you, it's always a good idea to have a physical reference with summaries, reports and records. That way you can make your own personal notes and wise decisions about where to make changes. You should always be able to see where you stand so you won't get hit with any surprises. Having one place to store receipts and printed documents can also keep you from searching for hours when you need something.

3 | HOW-TO GUIDES & MANUALS

How-to guides and policy manuals are amazing to have on hand for the small details of your business. Pretend you're getting ready to train a new employee. Instead of needing to spend the first few weeks micromanaging and over-explaining how you do things, what if you had how-to guides with details of the way you want things managed? Now even if you're a small business or determined to work alone forever, these type of guides help you to manage yourself. Whenever you discover a process that works, document it in detail. Along with helping you to be confident in what needs to be done, it will also help you be really consistent with your customers.

4 | TOOLS FOR THE SMALL DETAILS

I'm all about automating systems and using tools to make things easier on myself. I personally love Mint & Quickbooks Self-employed for keeping track of my budgets, accounts and expenses. These are lovely little apps that you can log into and immediately know how you're doing at any time. For creating quick reference documents, I like Google Docs & Sheets or Evernote because you can access them at any time. For scheduling and time-management, I like google calendar, 30/30 app and Asana. For storing files online, I use Amazon S3 and Dropbox but I've heard great things about Google Drive and may be switching over soon. Find a few tools that work for you and can handle those small details.

Disclaimer: Affiliate links were used within this post and I may earn a commission for sharing. I do wholeheartedly recommend the products and services I share and all opinions are my own.

TODAY'S ACTION STEP:

Decide if you need to put any new administrative systems in place for your own business. You can use the space in your workbook to create your own weekly maintenance checklist, take note of documents you want to put in a finance binder or manual and write down some tools to try. (*Note: if you're already subscribed and are having trouble accessing this page, email me for a refresher on the password. xo)